For many of us, receiving a paycheck is a source of excitement and relief. However, it’s equally important to understand what your pay stub represents and how to read it properly. Your pay stub contains valuable information about your earnings, taxes, and deductions. Here’s why it’s important to understand your pay stub:

- Ensures accuracy: By understanding your pay stub, you can ensure that your employer is paying you the correct amount. You can verify that your hourly rate, hours worked, and any overtime pay are accurate. You can also double-check that your taxes and deductions are being calculated correctly.

- Helps with budgeting: Your pay stub shows your gross earnings, net pay, and deductions. By understanding this information, you can budget your finances better. You can calculate how much money you’ll have left after taxes and deductions and plan accordingly. This can help you avoid overspending and falling into debt.

- Provides insight into your benefits: Your pay stub shows any benefits you receive, such as health insurance, retirement contributions, and vacation time. Understanding this information can help you take advantage of your benefits and plan for the future.

- Facilitates tax filing: Your pay stub provides valuable information for tax filing. It shows your gross earnings, taxes withheld, and any deductions. This information is essential when filing your taxes, and it can help you avoid any errors or discrepancies.

- Protects against fraud: Understanding your pay stub can help you identify any fraudulent activity. If you notice any discrepancies, such as incorrect earnings or unauthorized deductions, you can bring it to your employer’s attention and rectify the situation.

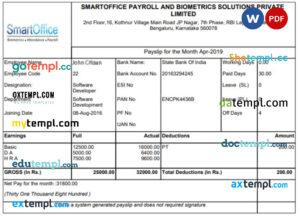

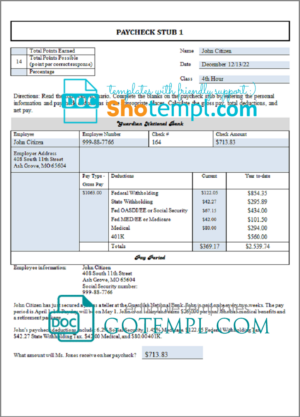

Here is an example of a pay stub:

In conclusion, your pay stub is more than just a document that shows how much money you earned. It’s a valuable tool that can help you budget your finances, plan for the future, and protect yourself against fraud. By understanding your pay stub, you can ensure accuracy, facilitate tax filing, and take advantage of your benefits. So the next time you receive a pay stub, take the time to read it carefully and understand its contents. ???

Sumitomo Mitsui Financial Group enterprise account statement Word and PDF template

Sumitomo Mitsui Financial Group enterprise account statement Word and PDF template  INDIA SMARTOFFICE and Biometrics Solutions Private Limited Payroll template in Word and PDF formats

INDIA SMARTOFFICE and Biometrics Solutions Private Limited Payroll template in Word and PDF formats  money tracker guide for direct payments - bank statement example, Word and PDF format

money tracker guide for direct payments - bank statement example, Word and PDF format  Qatar Development Bank bank account closure reference letter template in Word and PDF format

Qatar Development Bank bank account closure reference letter template in Word and PDF format  # define curl universal multipurpose invoice template in Word and PDF format, fully editable

# define curl universal multipurpose invoice template in Word and PDF format, fully editable  North Korea hotel booking confirmation Word and PDF template, 2 pages

North Korea hotel booking confirmation Word and PDF template, 2 pages  # good liker pay stub template in Word and PDF format

# good liker pay stub template in Word and PDF format  United Kingdom SSE Energy utility bill template in Word and PDF format, version 2

United Kingdom SSE Energy utility bill template in Word and PDF format, version 2  # net electric universal multipurpose utility bill, Word and PDF template

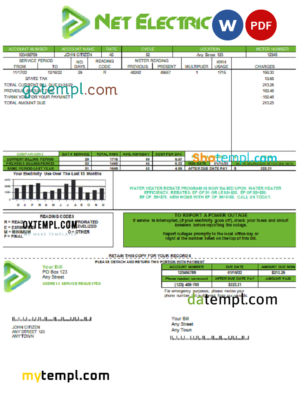

# net electric universal multipurpose utility bill, Word and PDF template  Singapore passport PSD files, scan and photo look templates (2006-2017),2 in 1

Singapore passport PSD files, scan and photo look templates (2006-2017),2 in 1  UAE Abu Dhabi Bank Alfalah statement Word and PDF template

UAE Abu Dhabi Bank Alfalah statement Word and PDF template  USA Colorado driving license template in PSD format

USA Colorado driving license template in PSD format  India ID card template in PSD format, fully editable, with all fonts

India ID card template in PSD format, fully editable, with all fonts  Philippines marriage certificate PSD template, completely editable

Philippines marriage certificate PSD template, completely editable  Modern Resume template in WORD format

Modern Resume template in WORD format