Starting a new business can be both an exciting and daunting experience. From conceptualizing your product or service to developing a marketing strategy, there are several things to consider before launching your venture. However, one of the most important aspects of starting a business is obtaining the necessary documentation to operate legally. One such document is the IRS Employer Identification Number (EIN).

What is an EIN?

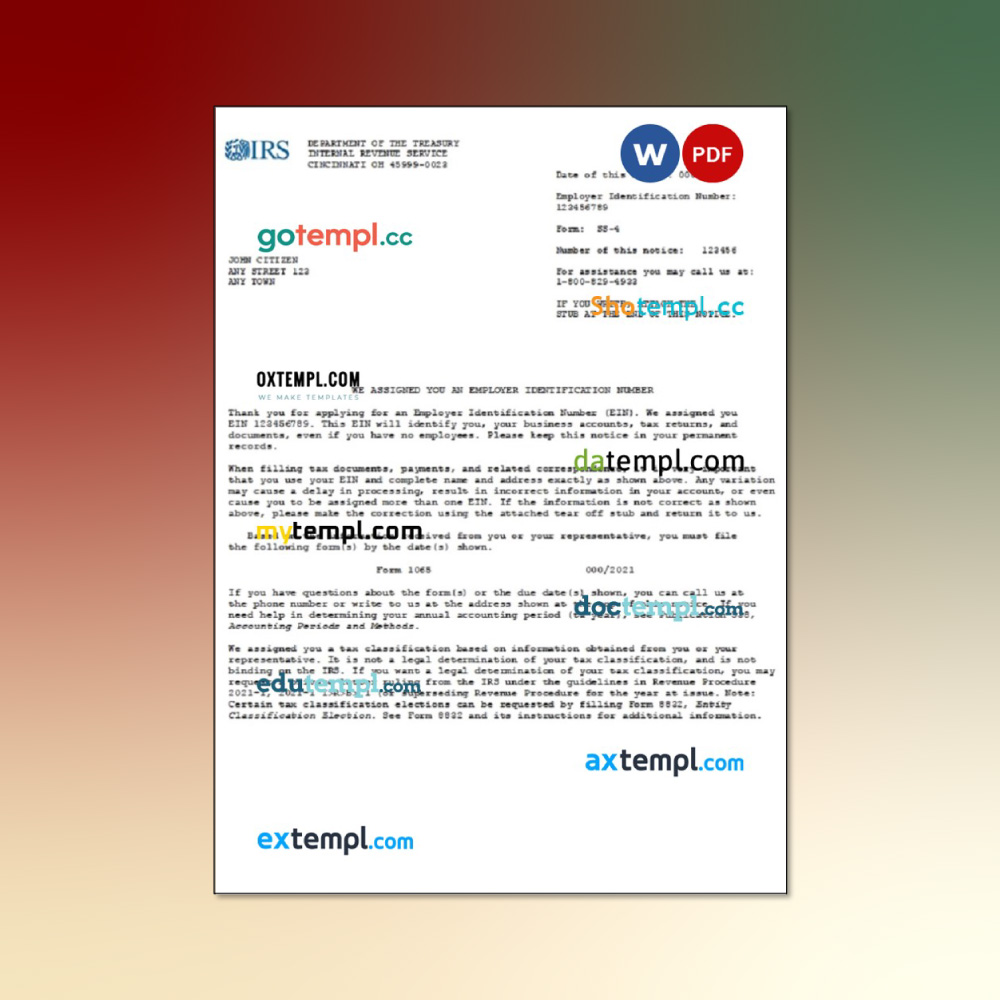

An EIN is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity. It’s similar to a social security number but is used for business purposes. Every business entity, whether it’s a sole proprietorship, partnership, LLC, corporation, or non-profit organization, is required to have an EIN for tax purposes.

Why is an EIN important for your business?

There are several reasons why obtaining an EIN is important for your business. Firstly, it’s required by law. The IRS requires all businesses to have an EIN to file taxes, open a bank account, hire employees, and apply for a business license or permit. Without an EIN, your business can’t operate legally.

Secondly, having an EIN can protect your personal assets. If your business operates as a sole proprietorship, you’re personally liable for any debts or legal issues that arise. However, if you incorporate your business or form an LLC and obtain an EIN, your personal assets are separate from your business assets. This means that in the event of a lawsuit or debt, your personal assets won’t be at risk.

Lastly, having an EIN makes it easier to conduct business transactions. If you want to open a business bank account, apply for a business credit card, or enter into contracts with suppliers or vendors, you’ll need an EIN. It’s a simple and straightforward process that can save you time and hassle down the line.

How do you obtain an EIN?

Obtaining an EIN is a relatively easy process. You can apply online through the IRS website, by mail, fax, or phone. The quickest and most convenient way to apply is online. The application process takes about 15 minutes, and you’ll receive your EIN immediately upon completion.

Or you can download the template from here: EIN

To apply for an EIN online, you’ll need to provide the following information:

- Legal name and mailing address of your business entity

- Name and social security number of the responsible party

- Type of business entity (sole proprietorship, partnership, LLC, corporation, etc.)

- Reason for applying for an EIN

Once you’ve completed the application, the IRS will process your request and issue your EIN immediately.

Conclusion

In conclusion, obtaining an EIN is an important step in starting a business. It’s required by law, protects your personal assets, and makes it easier to conduct business transactions. The process is simple and straightforward, and the benefits are significant. So if you’re starting a business, be sure to obtain an EIN to ensure that your business operates legally and efficiently.